- Enable your Online Banking Alerts!

- Check and review your accounts regularly.

- Secure your online accounts. Use unique passwords for each account and avoid saving your passwords on websites or web browsers.

- Ensure your mobile device/computer is secured with password/biometrics and no one else has access to these devices.

- Enable Multi-Factor Authentication (MFA) on your email and banking accounts, where possible. This adds another layer of protection!

Avoid entering passwords on computers or mobile devices that do not belong to you.

- Selling or buying online?

- Always meet up at safe havens (police/fire stations). If the meeting point is not suitable, ask to change the location to a safe location or decline the business transaction.

- Always purchase from reputable dealers, do your background checks before sending online transfers for payment of goods or services.

Only shop on sites with HTTPS and a padlock icon located either to the right or left of the URL. How to identify a fake website?

- Does the website/app look poorly designed? Does it have broken links?

- Are there any grammatical errors in the URL or the webpage?

- Ads with Incredible deals that are too good to be true.

Never respond to pop-up messages on websites/social media that request your financial information.

- Only access sensitive information (such as online banking sites, emails, etc.) when connected to a trusted network. For example, your home, mobile or work network.

Pay close attention to the privacy and security policies of the sites you visit to understand how your information is being used.

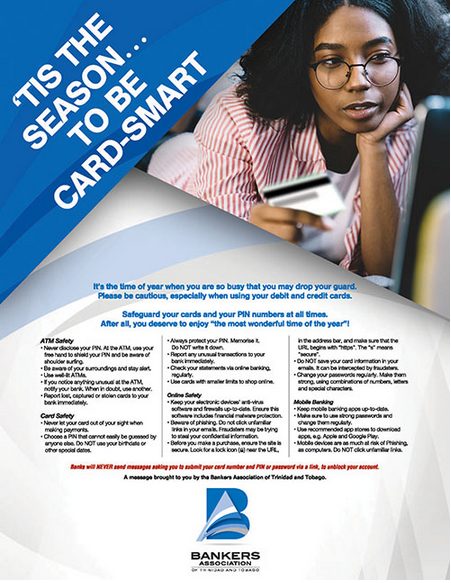

- Always verify your transaction amount before using your card

- Do not leave your card unattended or allow other people to use your card

- Use your body to shield your PIN from shoulder surfers (at ATMs as well)

- If a transaction does not go through while using the machine, ask for a receipt of transaction, check your online banking.

- Do NOT share your PIN or accept help from strangers at the POS or ATM.

- Safeguard your PIN and Never let your Bank cards out of sight! If you suspect that your card is lost or stolen, immediately report it!

This involves the use of a card reading device that copies the account information from your debit or credit card when swiped. Point of sale machines such as gas pumps or ATMs are most susceptible to skimming devices. The devices are very small and can be installed on the outside of machines and look as if they belong there. Once perpetrators have acquired this information, they can create a clone of your debit/credit card to withdraw large amounts of money from your account unknowing to you. Before using any machine, customers should take a look to ensure it hasn’t been tampered with.

This involves a fraudster looking over your shoulder to observe you enter your PIN to conduct a transaction typically at an ATM or payment terminals. Customers should shield the keypad by using their body or hand and also be aware of their surroundings.

Common Fraud Schemes and Fraudulent Activities

A type of fraud involving the exploitation of persons who seek a romantic partner or companion using various social media platforms. Victims are befriended by scammers and convinced to transfer money to a bank account.

Tips

- Be wary of love scams (if it is too good to be true, it is probably too good to be true).

- Be wary of urgent call to actions, whether it is via email, WhatsApp or text message. Ask yourself:

- Do I know the sender?

- Is this a legitimate sender?

- Is there another means to make contact to verify the legitimacy of the sender?

- Can I afford to lose this money?

An e-mail from a hacked or deliberately altered address containing instructions to benefit the sender or another person or entity. The scammers almost always pretend to be a person of power within the organization and can send an email from an address similar (but not the same) to the actual email of the CEO or high-ranking executive of the company. To discourage checking back with the ‘sender’ the bogus email usually states that the sender cannot be reached. BEC targets companies that do business with foreign suppliers and/or companies that have frequent wire transfers.

Employees should learn how to identify common BEC scenarios such as email with a tone of extreme urgency, check the email sender’s domain name (Email address) and never click a link unless you are sure you are being directed to a secure authentic website. If unsure of the email, contact the company to verify the email before you proceed to action.

With this type of fraud, you are contacted by either a recorded phone message or by email and directed to call a phone number or go to a website to enter personal information. Fraudsters tend to use this method to impersonate various agencies and charities.

A form of cybercrime where fraudsters, pretending to be from reputable organisations, use emails or text messages to trick you into revealing personal information such as your email password or credit card number.

These emails may request that you click on a link which takes you to a fraudulent website resembling that of the authentic website. The message is usually sent as ‘urgent’ and normally threatens consequences if you do not log-in or take action immediately.

The emails or text messages may also tend to appear attractive or too good to be true, advising the recipient that they “Won” a large sum of money, or a luxurious item and they are required to click the link to claim their prize.

To prevent phishing

- Do not open any emails or messages that you are not expecting. Instead, review the contents as a preview and check for grammatical errors in the sender’s address and the preview.

- Also, look out for irregular company colors, logos or formatting. You can place the cursor over the link (without clicking) to see where it will take you. Most phishing links will re-direct you to a fake site.

This can take various forms such as Ponzi/Pyramid schemes, fraudulent offering of stocks and real estate or commodities. Individuals are tricked into making financial investments with the promise of a high return. It often sounds too good to be true by promising high returns with little or no risk. There is also a lack of transparency and documentation.

Tips

- Be wary wealth redistributions schemes and/ or investment scams (new age sous sous) (if it is too good to be true, it is probably too good to be true).

- Be wary of urgent call to actions, whether it is via email, WhatsApp or text message. Ask yourself:

- Do I know the sender?

- Is this a legitimate sender?

- Is there another means to make contact to verify the legitimacy of the sender?

- Can I afford to lose this money?

This scam involves a local online courier service/import company which falsely advertises electronic items such as television screens, cellular phones and tablets for sale via social media platforms. Victims then transfer money for the purchase of the advertised item however no item is delivered as promised. Customers should only make purchases with reputable businesses.